Ready to reach financial independence through real estate? Whether you are looking for investment property loans or a vacation home to spend relaxing days, Guarantee Mortgage College Station can bring the same level of personalized attention and service to all of your real estate purchases.

Your dream home might be within reach! Guarantee Mortgage College Station can help with investment property loans. Our prequalification process will ensure that you are ready to buy and we can help you find a real estate agent to meet your needs.

INVESTING IN A RENTAL? GET QUALIFIED BASED ON EXPECTED MONTHLY RENTAL INCOME

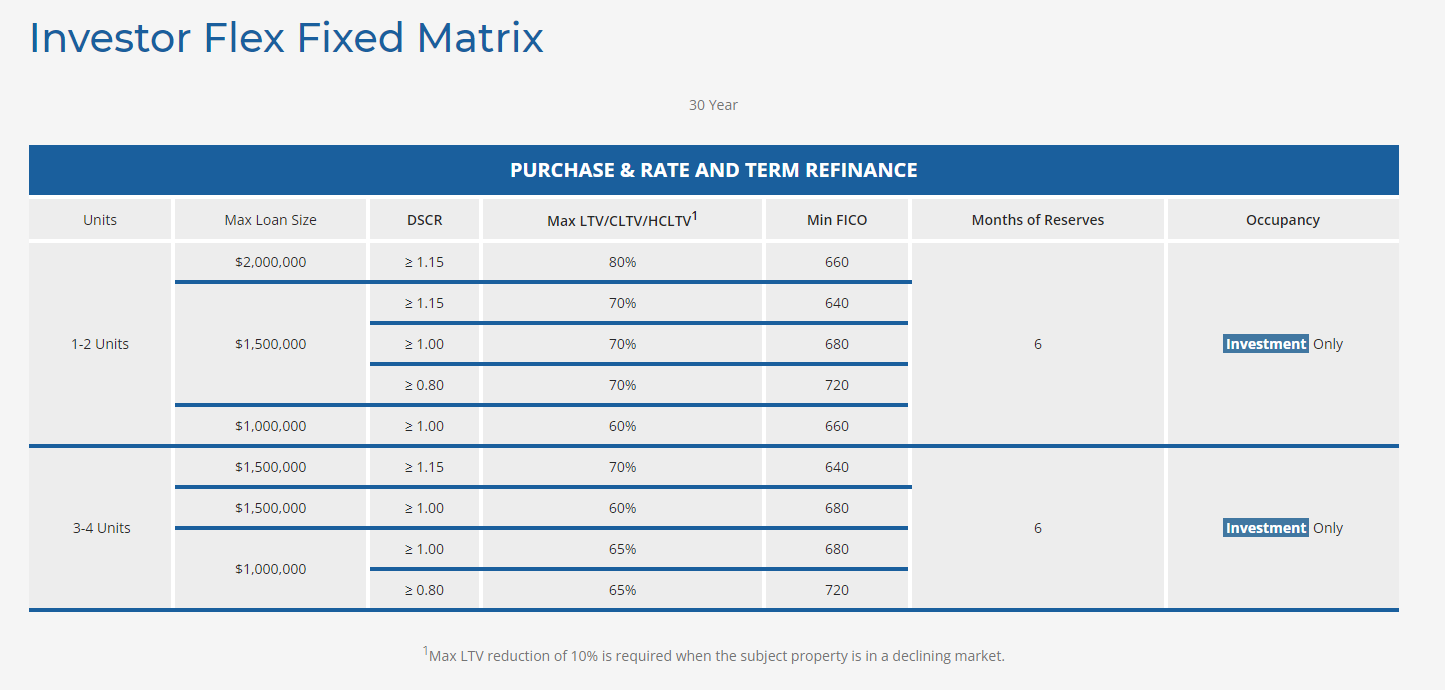

Looking to expand your rental income portfolio? We can help! Our Debt-Service Coverage Ratio (DSCR) loan allows you to qualify for an investment property based on the prospective monthly rental income.

TIME TO EXPAND YOUR REAL ESTATE PORTFOLIO

It’s never been easier to purchase multiple investment properties, and we’re here to help! We have a Debt-Service Coverage Ratio (DSCR) loan that allows you to qualify based not on your current income, but the property’s prospective monthly rental income.

You can finance up to 20 short-term or long-term rental properties with loans up to $2M.

So, whether you are just getting started or looking to grow, here’s your chance to expand your real estate portfolio. Give us a call today and learn more about the DSCR loan!

This is a great opportunity for those looking to get started with rental properties, as well as those looking to grow. Give us a call, and let’s talk about the possibilities!

All-in-One Solution

Everything You Need for Success...

Get started today!

Fill out the questionnaire on this page to start a discussion about your mortgage needs today!